Bad Credit Home Improvement Loans – Home Improvement Personal Loan Options

Bad Credit rating Home Remodeling Loans– Property Improvement Personal Financing Options

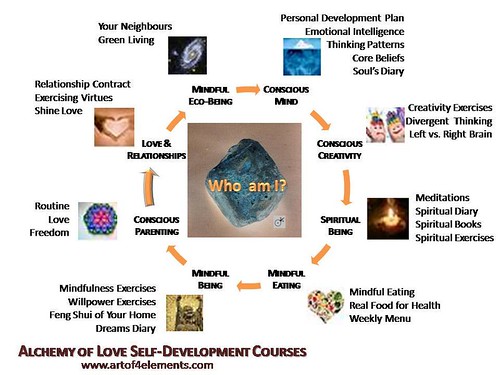

Source: Flickr

House improvement ventures are actually costly, and also a lot of property owners opt to finance the venture. Having a high credit history score creates acquiring a property renovation lending effortless. While unpleasant credit rating is going to certainly not make it possible for a home owner coming from protecting funding, the possibilities of receiving a really good price are low. Here are a few short alternatives offered to assist homeowners acquire permitted for a poor credit report house enhancement loan.

Safe Home Improvement Funding

If your credit score rating is reduced, creditors will definitely certainly not authorize a financing request for an unsecured financing. Hence, homeowners need to resort to securing a protected individual loan, which needs collateral.

When home remodelings are actually required, many home owners capitalize on their home’s equity. There are 2 types of home equity loan options, and also both of these are protected through your home’s equity. If getting a residence capital financing, homeowners may get a round figure of money that might be utilized for any purpose. Usual uses include residence improvement properties, financial debt consolidation, and so on

. Yet another choice consists of the property equity credit line. With this lending alternative, residents open a line of credit with a home mortgage lending institution. As required, the house owner may take out funds from the account considering a debit card or even check book. This choice is actually best for property owners that are carrying out lots of residence improvement jobs over an extended size of your time.

Various other Funding Options for Property Enhancement Projects

Since residence equity funding alternatives are actually safeguarded by a home’s equity, property owners have to keep routine settlements. Defaulting on a property equity financing has major outcomes. To stay away from the risk of losing their property and equity, some house owners explore various other choices.

If must pay for a simple, low-cost house renovation venture, property owners featuring poor credit history may take into account applying for a short term payday loan loan. Some cash advance loan providers give financings up to $3000. This is excellent for little home improvement properties.

Cash advance loan companies need repayment of funds within 14 to 1 Month. Before making an application for a short term funding, borrowers ought to examine their personal funds. Financings require no credit inspection or even collateral. However, if a borrower fails to settle the loan or pay plans, the loan company can easily seek an opinion versus the customer.